A Comprehensive Guide to Social Security Survivor Benefit Options

Short and Sweet Summary: Social Security survivor benefit options are a godsend for widows and their families whose financial support drastically changed after the death of a spouse. But survivor benefits can be confusing, so this guide breaks down the benefit options in an easy-to-understand way. And includes examples of benefit allocations!

Most of you know that the government collects social security taxes for retirement programs, but some taxes paid go toward benefits for surviving spouses and children when a partner or parent dies. This Social Security survivor benefit is a lifesaver for families whose financial support ended when the primary wage earner died.

Here is the list from the Social Security Administration (SSA) website of who can receive survivor benefits. Do you or your children fall into any of these categories?

- Widow age 60 or older

- Disabled Widow

- Widow caring for deceased’s children under 16 or disabled

- Your Children up to age 18

- Children age 18-19 if attending elementary or high school full-time

- Disabled Children over 18 if they become disabled before age 22

Hopefully, you’ve already made or attended an appointment with the SSA to set up your benefits and start receiving payments.

If you haven’t contacted the SSA yet, you can’t apply for benefits online. You must make an appointment. Click here for the Social Security office locator.

Even if you’re receiving benefits, you might still have questions about your claiming strategies. It’s important to review your options from time to time because your life circumstances may change (change/leave job, child ages out of benefits, etc).

Let’s dig deeper into what each of these options means. And answer a few common questions about survivor benefits.

PSA: I’m not a Social Security Administration representative, lawyer, disability specialist or crystal-ball reviewer, and I don’t play one on the Internet. Please don’t assume the accuracy of the information presented without consulting with the Social Security Administration about your specific case.

ACRONYMS YOU NEED TO KNOW

Before we start, you’ll see these acronyms keep popping up. Keep them handy for future reference.

Primary Insurance Amount (PIA)

Primary Insurance Amount (PIA):

Full Retirement Age (FRA)

The age when you are entitled to 100 percent of your Social Security benefits.

Family Maximum Benefit (FMB)

The limit to the amount of money the SSA can pay to a family.

WIDOW AGE 60 OR OLDER

If you’re a widow age 60 or older, you can apply to receive a social security widow survivor benefit based on your spouse’s Primary Insurance Amount (PIA) or what he would have received at Full Retirement Age (FRA).

You can claim a widow survivor benefit as early as age 60, unlike retirement benefits where the minimum age to collect is 62. Your age and whether you earn an income will determine how much of a widow survivor benefit you receive.

what happens if you remarry?

If you remarry before age 60 you forfeit any claim to a widow survivor benefit. However, you can remarry after age 60 with no penalty.

You must remain unmarried to claim a widow survivor benefit. But you can claim survivor benefits and remarry after age 60 with no disruption in benefits.

How age and income determine your benefit

If you work, are younger than your FRA and want to claim a widow survivor benefit, the SSA may reduce your survivor benefit if your earnings exceed a certain limit. The document How Work Affects Your Benefits describes how the SSA will deduct $1 from your benefits for each $2 you earn above $18,240.

Even if you don’t work, when you receive a widow survivor benefit prior to your FRA, the benefit is reduced because you’ll receive benefits for a longer period.

See this chart to determine your FRA.

Survivor benefits that start at age 60 are always reduced by 28.5 percent. You’ll be receiving benefits for a longer period of time because you’re claiming before your FRA. The advantage of a widow survivor’s benefit is that you can claim it earlier than a retirement benefit. But the disadvantage of claiming early is the benefit reduction.

The decision to claim or not claim early is an individual decision based on your current financial situation. Is it always better to take a survivor benefit right at age 60? Not necessarily. Maybe you want to take a reduced retirement benefit first and let the widow benefit grow or vice versa.

To study your options a little closer, let’s look at an example of a fictional widow survivor benefit and a comparison of survivor vs. retirement benefits.

Example of a widow survivor benefit

Let’s say you’re a 60-year-old widow with no retirement benefits who applies for a widow survivor benefit. Your spouse’s PIA at his FRA would have been $2,000/month, so this is the number the SSA will use in its benefit calculation.

Remember, your benefit is reduced by 28.5 percent if you claim before your own FRA. So, if you claim a widow survivor benefit at age 60, you’ll only receive 71.5 percent of your spouse’s PIA or in this example, $1,430. However, the benefit amount increases each year you delay claiming until you reach your FRA at which time you’ll receive the full benefit amount because incremental increases stop at your FRA.

See the table on the Benefits Planner: Survivors | Receiving Survivor Benefits Early for more examples of benefit amounts based on birth year.

Comparing survivor and retirement benefits

But what if you have your own retirement benefit?

Well, here’s where it gets interesting…

You can claim a reduced widow survivor benefit at age 60 and let your own retirement benefit continue to grow. Your retirement benefit grows incrementally each year until age 70 when incremental increases stop.

So, if you wait until age 70 to collect your own retirement benefit, your monthly benefit amount would increase by 132%! That means, at age 70, you could switch from your reduced widow survivor benefit to your own retirement benefit if it’s higher.

Let’s say you’re a 60-year-old widow with her own retirement benefit. You need to decide whether to apply for a widow survivor benefit or your own retirement benefit first.

Your spouse’s PIA at his FRA would have been $2,000/month so this is the number the SSA will use in your widow survivor benefit calculation. However, your retirement benefit at your FRA is $1500.

Which benefit should you take first?

In this example, you could claim a reduced widow survivor benefit of $1,430 at age 60 and then switch to your own retirement benefit of $1,980 at age 70 when it’s at its highest and no more incremental increases will apply.

Or you could wait until age 62 to take a reduced retirement benefit and switch to your widow survivor benefit at age 67 when it’s at its highest and no more incremental increases will apply.

Want a software program to figure this out for you? Click here to learn more about a data entry tool to help you get the highest lifetime benefits.

Recap

- You must remain unmarried to claim a widow survivor benefit at age 60.

- However, you can claim a widow survivor benefit and remarry after age 60 with no disruption in benefits

- You can work and claim a widow survivor benefit at age 60, but your benefit will be reduced by $1 for every $2 you earn above $18,240.

- If you claim a widow survivor benefit at age 60, the SSA will reduce your benefit by 28.5% because you’re claiming before your FRA.

- Your widow survivor benefit amount increases each year you delay claiming until you reach your FRA at which time you’ll receive the full benefit amount.

- Widow survivor benefit incremental increases stop at your FRA.

- You can claim a widow survivor benefit first and switch to your own retirement benefit later if it’s higher

DISABLED WIDOW

You can apply for a social security widow survivor benefit if you’re over age 50 and disabled.

Even if the disability occurred before age 50, you can’t apply for disabled widow benefits before you turn 50. Disabled widow benefits last from age 50 to 59½ at which time the benefits would switch to a regular non-disabled widow survivor benefit.

To apply for disabled survivor benefits, you must complete an Adult Disability Report because widow/widower disability is defined the same as regular workers. You must be able to prove a physical or mental condition that prevents you from working and is expected to last at least 12 months or longer.

Disability benefits automatically switch to retirement and/or widow survivor benefits when you turn 60.

WIDOW CHILD-IN-CARE BENEFIT

If you’re a widow caring for children who are either under age 16 or disabled, you’re eligible to receive what’s called a child-in-care benefit. The child is in your care, so you’re entitled to a survivor benefit.

The amount of the child-in-care benefit depends on your deceased spouse’s PIA. Your child-in-care benefit also depends on your own work income and if your children receive benefits too.

Working and claiming a child-in-care benefit

The Social Security Administration implements an income test if you continue to work while receiving benefits. You can work and receive benefits, but you’re only allowed to make a certain amount of money per year. Read Getting Benefits While Working for more information. You can also use the Retirement Earnings Test Calculator to see how your earnings could affect your benefit payments. Even though it’s a retirement calculator, the data applies to survivor benefits.

Lots of factors go into whether it’s a good idea to claim child-in-care benefits. One large caveat is that the SSA limits the amount of money it can pay to a family. Remember the FMB? If you claim the child-in-care benefit for yourself, it could reduce your children’s benefit. And, the benefit you receive is considered income so it gets reported to the IRS as potentially taxable.

Child-in-care benefits end for you when the child turns 16. In the case of a disabled child, benefits continue past age 16 when meeting certain conditions such as caring for a mentally disabled child or providing personal services for a physically disabled child.

The child-in-care benefit is for you, the widow. Which means it’s paid to you, in your name, coinciding with your social security number. Because it’s paid directly to you, the benefits might be taxable if you also receive any other employment income.

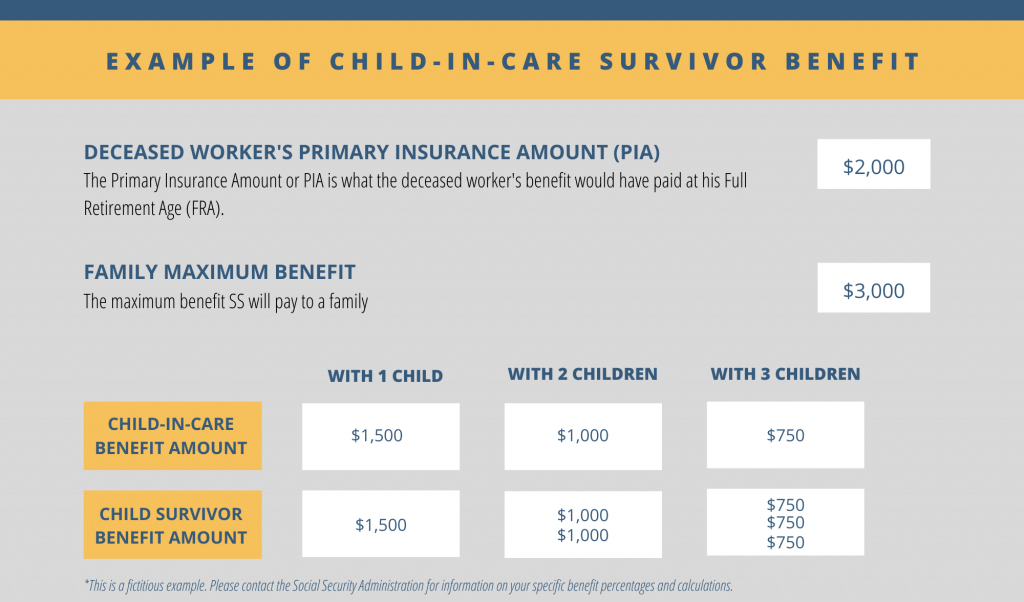

Example of child-in-care benefit

Let’s say you’re a 44-year-old widow with three kids who applies for child-in-care benefits. Your spouse’s PIA at his FRA would have been $2,000/month so this is the number the SSA will use in its benefit calculation.

A possible child-in-care benefit you may receive is 75% of your spouse’s PIA, or in this example $1,500. A possible child survivor benefit is also 75% of your spouse’s PIA, or in this example $1500.

A widow child-in-care benefit or a single child survivor benefit won’t increase past 75% of the deceased’s PIA. That’s the cap the SSA puts on individual amounts.

But the benefit amount gets smaller, per person, if you have more than one child. The FMB doesn’t change, the allocation changes based on the FMB.

As you can see, the amount per person decreases based on the number of family members who collect. If you collect a child-in-care benefit, the child survivor benefit amount is potentially decreased and redistributed according to the FMB.

It’s up to you and your family’s financial situation to determine if claiming a child-in-care benefit is the best choice.

CHILDREN UP TO AGE 18

Your child(ren) can receive a social security child survivor benefit based on your deceased spouse’s earnings record. This payment is in the child’s name, but paid to you, the parent (also called a Representative Payee), and deposited into your account. However, this payment is not recognized as income paid to you because it’s administered under the child’s social security number.

A Representative Payee is a person appointed to receive social security benefits for anyone who can’t manage his or her own benefits. Because minors can’t legally be responsible for managing money or assets, it’s paid to you, the parent, and you decide how to use the benefits. Benefits should be used for food, shelter, medical or dental care not covered by insurance and clothing or recreation.

You know, the basics of raising kids.

The SSA requests that you add any unused funds to a child’s savings account. But, if you’re like us, there are no funds leftover.

Raising kids is really freaking expensive.

Damn.

The child survivor benefit ends one month before his or her 18th birthday.

CHILDREN AGE 18-19 IF ATTENDING SCHOOL FULL-TIME

Your kids can continue receiving a child survivor benefit if they still go to school past age 18. But this only lasts until they graduate or two months after they turn 19.

So, technically, if your kid is a 5th year senior he could potentially still collect benefits for an additional year past his 18th birthday.

You must provide proof of attendance.

CHILDREN OVER 18 IF DISABLED BEFOR AGE 22

Your disabled child can continue to receive a child survivor benefit after reaching age 18, if the disability began before age 22.

COMMON QUESTIONS

So, the benefits are great but also really confusing. It might take more than one trip to your local SSA office to make sense of your numbers. Keep going back and keep asking questions until you understand your family’s numbers.

Don’t rely on widows in your Facebook groups to offer up the correct information. Go straight to the SSA representatives.

Must I keep track of spending?

No. The SSA abolished this rule in 2019.

You used to have to fill out and return a Representative Payee Report. Now, the SSA no longer requires a report from parents who reside in the same household as the child.

You can confirm this information here.

Should I take a child-in-care benefit if it reduces my children’s benefits?

This is completely a matter of personal and financial preference. But, keep in mind, the FMB cap determines the allocation of benefits. If you have more than two children your family may have already reached its FMB. It might not make sense for you to collect a child-in-care benefit because you’re already getting the max amount. Deciding which social security survivor benefit to claim or not claim should be based on your individual family circumstances.

Will child survivor benefits be redistributed to my other kids when their sibling reaches 18?

If you’ve reached the FMB within your family and one family member’s benefits stop, it’s possible the SSA could redistribute the remaining money to the other beneficiaries. Speak to an SSA representative directly with this question to understand your family’s circumstances.

It’s important to keep in mind, however, that a single child survivor benefit and a widow child-in-care benefit won’t increase past 75% of the deceased’s PIA. That’s the cap the SSA puts on individual amounts.

Are the survivor benefits taxable?

I created another post about the tax issues surrounding survivor benefits.

Read more here: The Top 5 Things You Need To Know About Widow Survivor Benefits

WIDO WRAP UP

Social security survivor benefit options help families whose primary wage earner died. These benefits are paid to a widow and/or her children for a specific time period and with specific calculations regarding funds received.

It’s important to understand all your claiming options because the calculations can be very confusing. And when family circumstances change, the benefit allocations could change, too. Review your numbers often and speak with an SSA representative as many times as necessary to maximize your family’s options.

Don’t be afraid to ask the questions that will provide the biggest benefit to your family.

I would love to read information on being a teacher and a widow, if I get my pension from school would I get any from widows benefits from my husbands record.My pension would be small Thanks for your time Michelle

Hi Michelle, chances are you won’t receive survivor benefits or at least not the full amount. The benefit would be reduced by two-thirds of your teacher’s pension amount under the government pension offset rule (GPO). The math is tricky, and if you ever worked in a job that did pay into social security, it’s even trickier. So your best bet is to talk to the SSA directly so they can explain the calculations.